LHDN MyInvois: Malaysia E-Invoice Compliance

The Malaysian Inland Revenue Board (LHDN) is mandating the implementation of e-Invoicing for tax purposes.

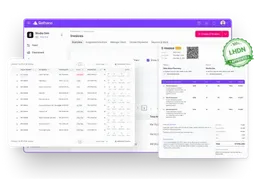

Under this requirement, invoices must be issued in machine-readable formats (XML or JSON), validated through LHDN’s MyInvois system, and securely stored for compliance. The system ensures invoice authenticity through real-time validation, mandatory data fields, digital signatures, and long-term digital archiving.

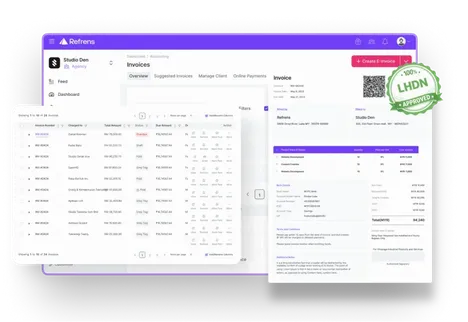

Refrens E-invoicing Software comply with LHDN’s e-Invoicing regulations, offering a seamless and compliant solution for your business.

LHDN’s e-Invoicing 2026 rollout phases:

1 January 2026: Mandatory for businesses with annual turnover between MYR 1 million and MYR 5 million 1 July 2026: Mandatory for all remaining businesses, including those with annual turnover below MYR 1 million, unless specifically exempted

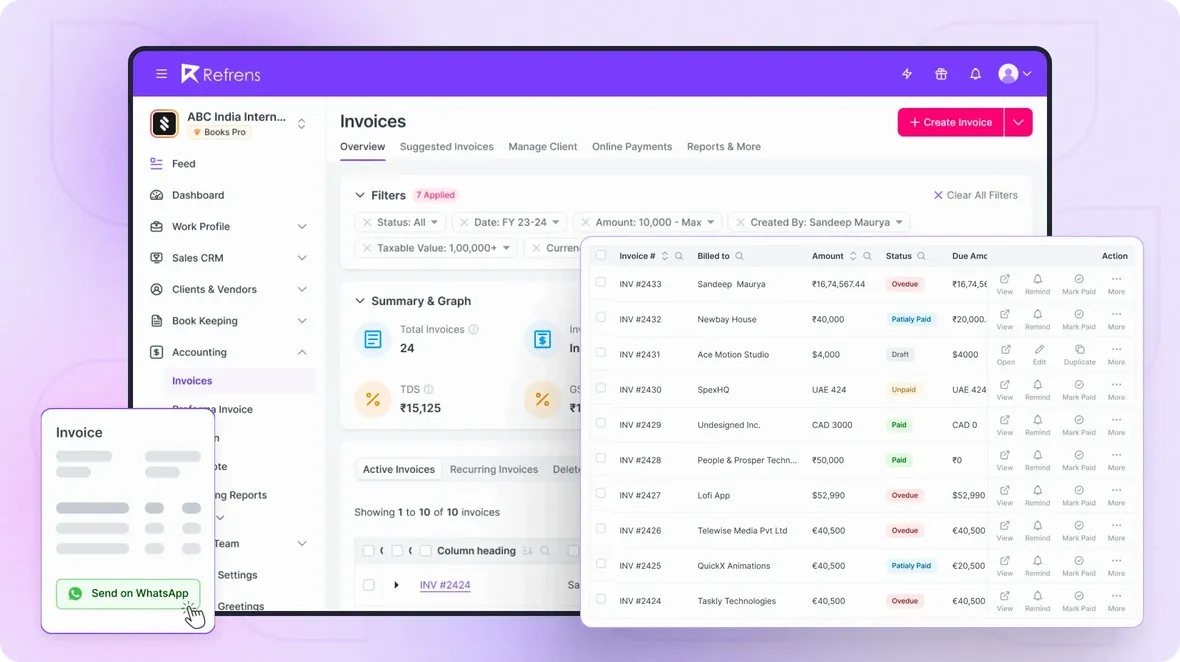

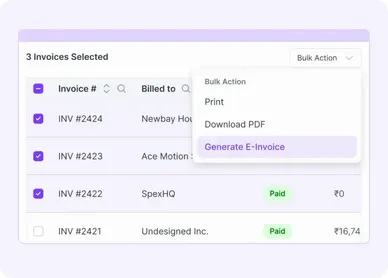

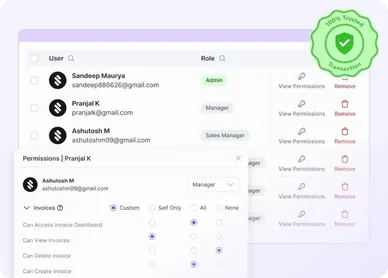

Key Features of Refrens E-invoicing Software

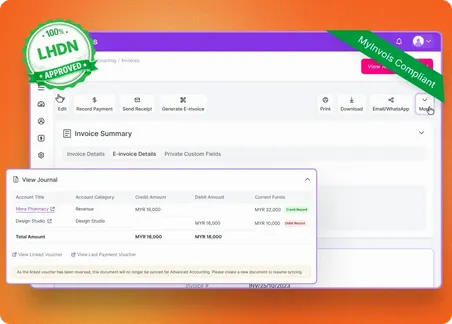

With Refrens, correcting or cancelling e-invoices is simple and fully aligned with MyInvois guidelines. Every change is properly recorded, validated, and synced with the tax portal, ensuring your accounting records and e-invoice data always stay consistent—reducing compliance risk.

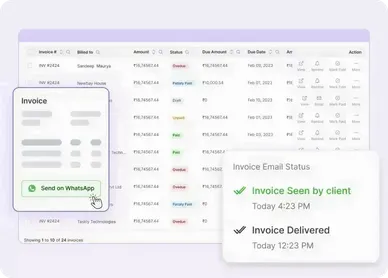

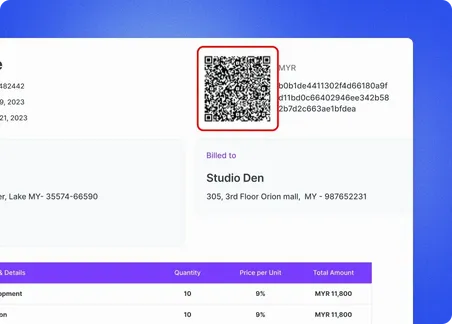

Refrens lets you share e-invoices via email, secure links or whatsapp in just a click. Each e-invoice includes all mandatory tax details, validation references, and QR codes required under Malaysia’s e-invoicing framework—so recipients receive complete, compliant documents every time.

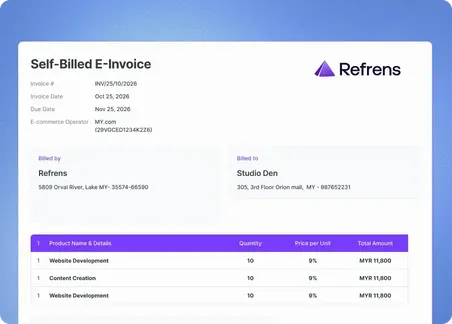

When suppliers are unable to issue e-invoices, Refrens helps you generate self-billed e-invoices effortlessly. Create compliant documents directly from your accounting data and submit them seamlessly to MyInvois—ensuring accurate reporting and zero manual work.

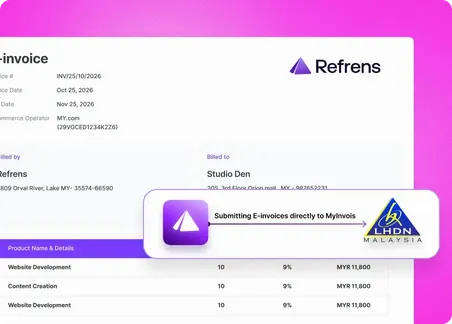

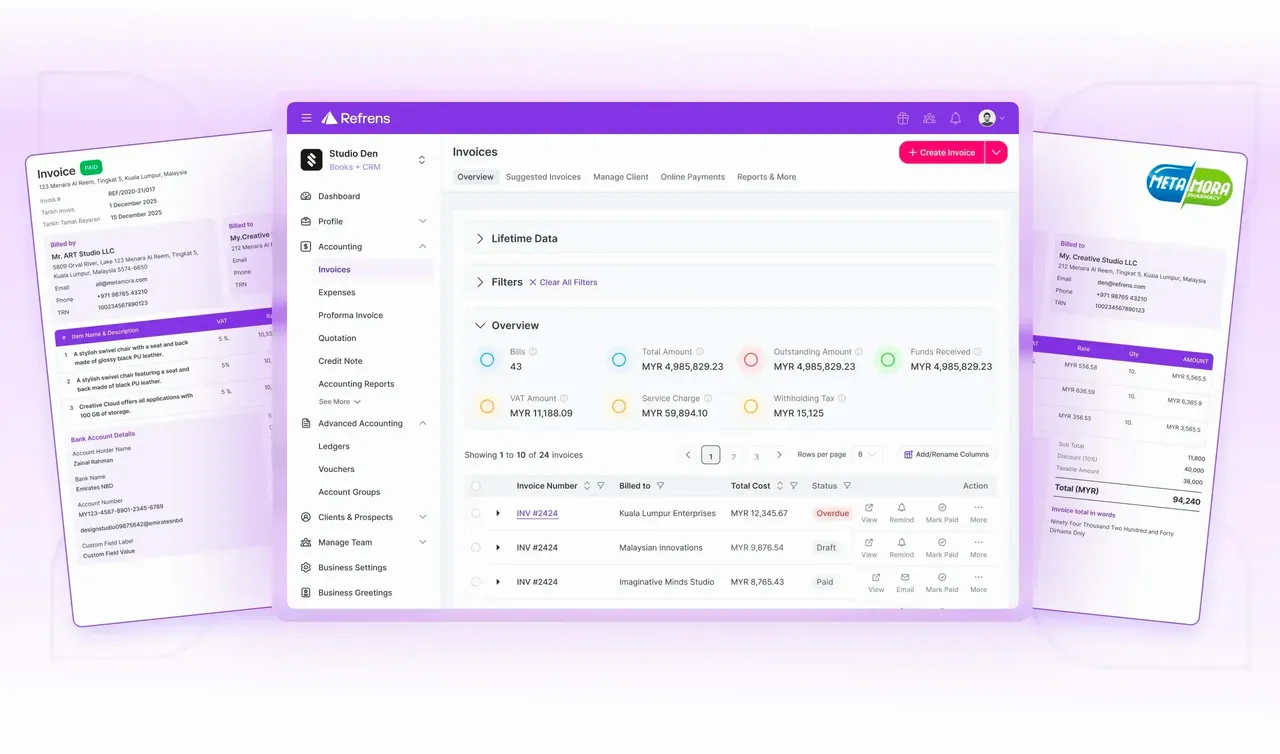

Refrens generates and submits e-invoices directly to MyInvois from the platform. The system validates data, applies the required formats, and ensures timely submission—helping you avoid delays, rework, and penalties.

Refrens Accounting Software is designed to comply with MyInvois and MyTax standards. It ensures correct invoice structures, validation rules, audit trails, and reporting—so your business stays aligned with LHDN guidelines at all times.

Set up automated payment reminders linked directly to your e-invoices. Refrens sends timely reminders before and after due dates, helping improve cash flow while keeping your accounting records updated automatically.

Every e-invoice generated through Refrens includes an auto-generated QR code. Customers and authorities can instantly verify invoice details, validation status, and tax information—making transactions more transparent and reliable.

Generate invoices fully compliant with Malaysian SST regulations, including accurate tax breakdowns, business registration details, and mandatory invoice fields. Customize your SST invoice template with automated calculations and professional layouts—ensuring seamless, compliant, and efficient billing for your business in Malaysia.

Refrens Keeps You Aligned With Government Data

Why Refrens is the most trusted e-invoicing software in Malaysia?

Our advanced automation ensures that 80% of your data entry work gets automated. This helps you save on time & manpower costs.

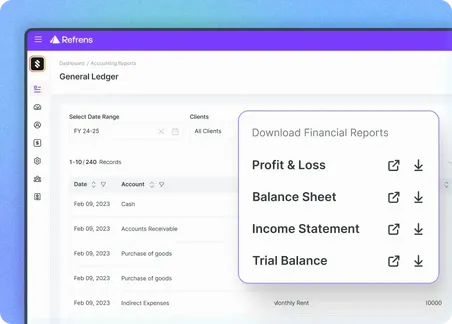

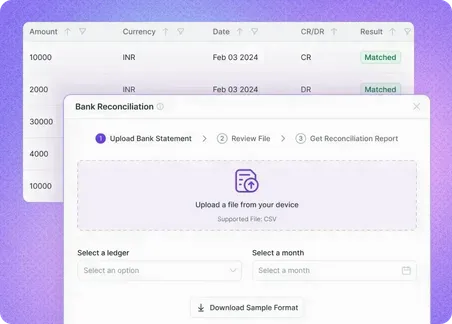

With Refrens simplify your finances with automated bookkeeping, smart bank reconciliation, invoicing, expense tracking, and tax management. Get real-time reports, profit & loss statements, balance sheets, and cash flow insights, so you can save time, reduce errors, and make smarter financial decisions.

Additional Features of Our E-Invoicing Software

Pricing of Refrens e-Invoicing software for Malaysia

Only Pay When You Need Premium Features.